PayAdmit¶

Unlock the power of PayAdmit's advanced payment technical solutions.

Website: payadmit.com

Set up Account¶

Step 1: Create merchant account¶

To create an account send connection request at the payadmit.com or contact manager directly. Submit the required documents to verify your account and gain access.

Step 2: Get required credentials¶

Credentials that have to be issued:

- API Key

- Signing Key

Connect H2H Merchant Account¶

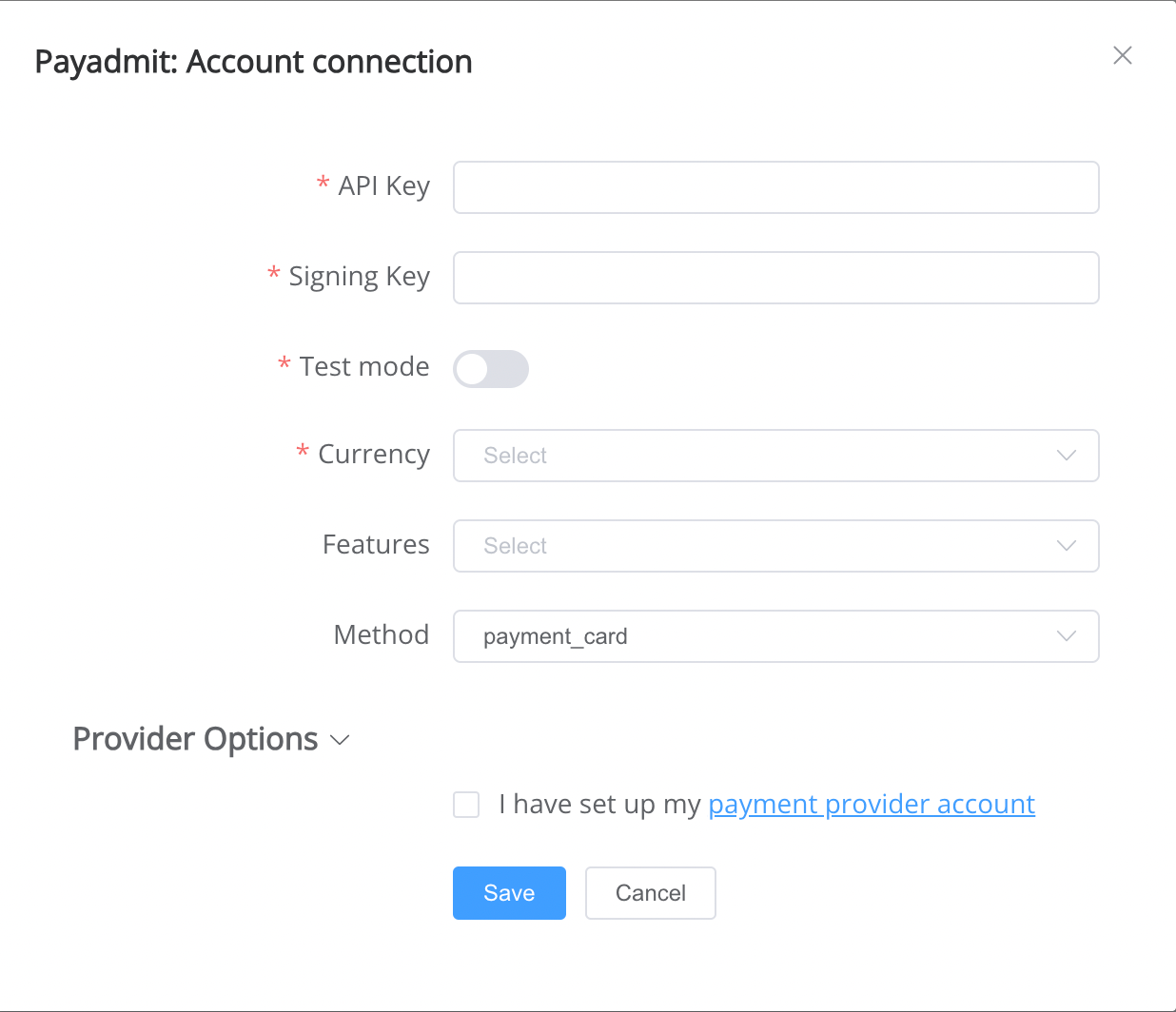

Step 1. Connect H2H account at the Corefy Dashboard¶

Press Connect at PayAdmit Provider Overview page in 'New connection' section and choose H2H Merchant account option to open Connection form.

Enter credentials:

- api_key → API key

- signing_key → Signing key

Choose currency → You can set these parameters according to available currencies and features for your PayAdmit wallets and services, but it's necessary to check details of the connection with your Corefy account manager.

Success

You have connected PayAdmit H2H merchant account!

Connect Provider Account¶

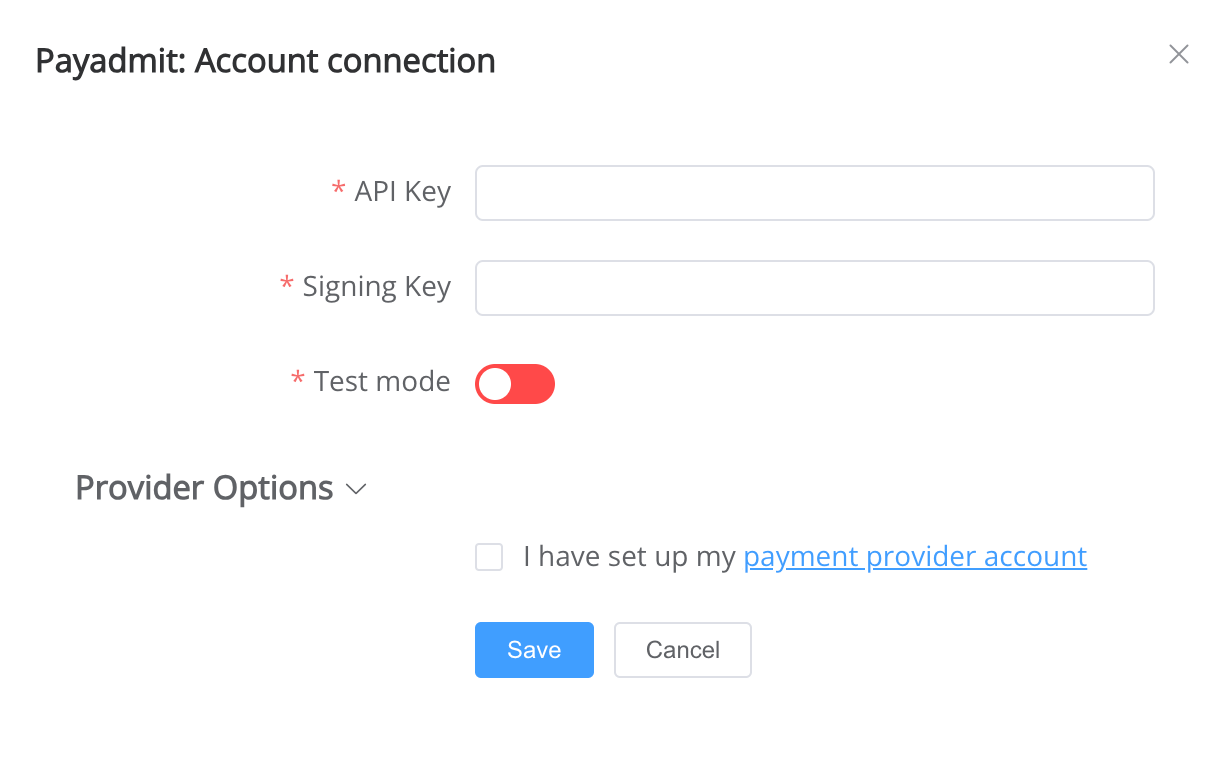

Step 1. Connect Provider account at the Corefy Dashboard¶

Press Connect at PayAdmit Provider Overview page in 'New connection' section and choose Provider account option to open Connection form.

Enter credentials:

- api_key → API key

- signing_key → Signing key

Success

You have connected PayAdmit Provider account!

API examples for H2H Merchant account:¶

Min data set to create a transaction¶

POST /api/commerce/payment-invoices HTTP/1.1

{

"data": {

"type": "payment-invoice",

"attributes": {

"service": "payment_card_eur_hpp",

"commerce_account": "Hello World",

"currency": "EUR",

"amount": 12.35,

"flow": "charge",

"test_mode": false,

"options": {

"allow_partially": false

},

"reference_id": "6907764e-d82f-43ee-b514-b91fc6c89dbb"

}

}

}

Max data set to create a transaction¶

POST /api/commerce/payment-invoices HTTP/1.1

{

"data": {

"type": "payment-invoice",

"attributes": {

"service": "payment_card_eur_hpp",

"commerce_account": "Hello World",

"currency": "EUR",

"amount": 12.35,

"flow": "charge",

"test_mode": false,

"options": {

"allow_partially": false

},

"reference_id": "6907764e-d82f-43ee-b514-b91fc6c89dbb",

"customer": {

"referenceId": "1bf9bb8e-7661-4872-863f-c389b5043059",

"citizenshipCountryCode": "UA",

"firstName": "John",

"lastName": "Wick",

"dateOfBirth": "2023-07-26",

"email": "[email protected]",

"locale": "en",

"ip": "192.168.10.65",

"phone": "35712 3456789"

},

"billingAddress": {

"addressLine1": "United Kingdom",

"city": "London",

"countryCode": "UA",

"postalCode": "12345",

"state": "London"

}

}

}

}

API examples for Provider account:¶

Min data set to create a transaction¶

POST /api/commerce/payment-invoices HTTP/1.0

{

"data": {

"type": "payment-invoice",

"attributes": {

"service": "payment_card_eur_hpp",

"commerce_account": "Hello World",

"currency": "EUR",

"amount": 13,

"reference_id": "6c4ef795-bddd-4676-b9a4-12662420103f",

"flow": "charge",

"gateway_options": {

"cardgate": {

"tokenize": ""

}

},

"test_mode": false,

"options": {

"allow_partially": false

},

"service_fields": []

}

}

}

Max data set to create a transaction¶

POST /api/commerce/payment-invoices HTTP/1.0

{

"data": {

"type": "payment-invoice",

"attributes": {

"service": "payment_card_eur_hpp",

"commerce_account": "Hello World",

"currency": "EUR",

"amount": 12,

"reference_id": "6c4ef795-bddd-4676-b9a4-12662420103f",

"flow": "charge",

"gateway_options": {

"cardgate": {

"tokenize": ""

}

},

"customer": {

"reference_id": "f4a4051f-2c3c-4a98-8683-2d83ceeef6ea",

"name": "Danil Doe",

"email": "[email protected]",

"phone": "380956741235",

"date_of_birth": "2023-12-12",

"address": {

"full_address": "kabum streeet 13",

"country": "AF",

"region": "Djahmud",

"city": "Djahmud",

"street": "kabum streeet 13",

"post_code": "123456"

}

},

"test_mode": false,

"options": {

"allow_partially": false

},

"service_fields": []

}

}

}

Additional information¶

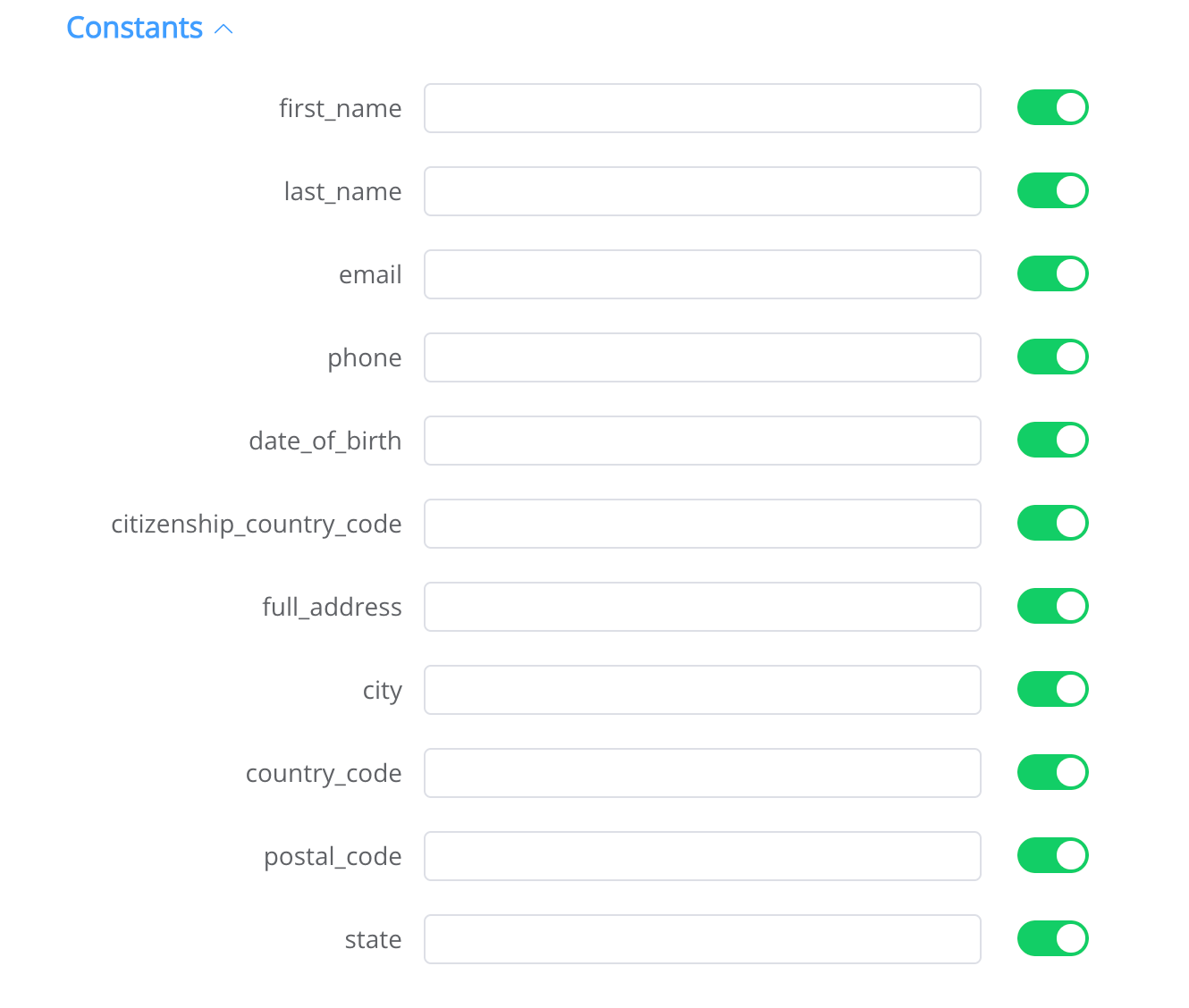

Constants¶

If some parameters are not sent in the transaction creation request, they will take the values from the set constants.

Here is a list of constants with their corresponding parameters:

- FULL_ADDRESS → customer [address] [fullAddress]

- COUNTRY → customer [address] [country]

- CITY → customer [address] [city]

- POST_CODE → customer [address] [postCode]

- REGION → customer [adress] [region]

- EMAIL → customer [email]

- NAME→ customer [name]

- PHONE → customer [phone]

- DATE_OF_BIRTH → customer [dateOfBirth]

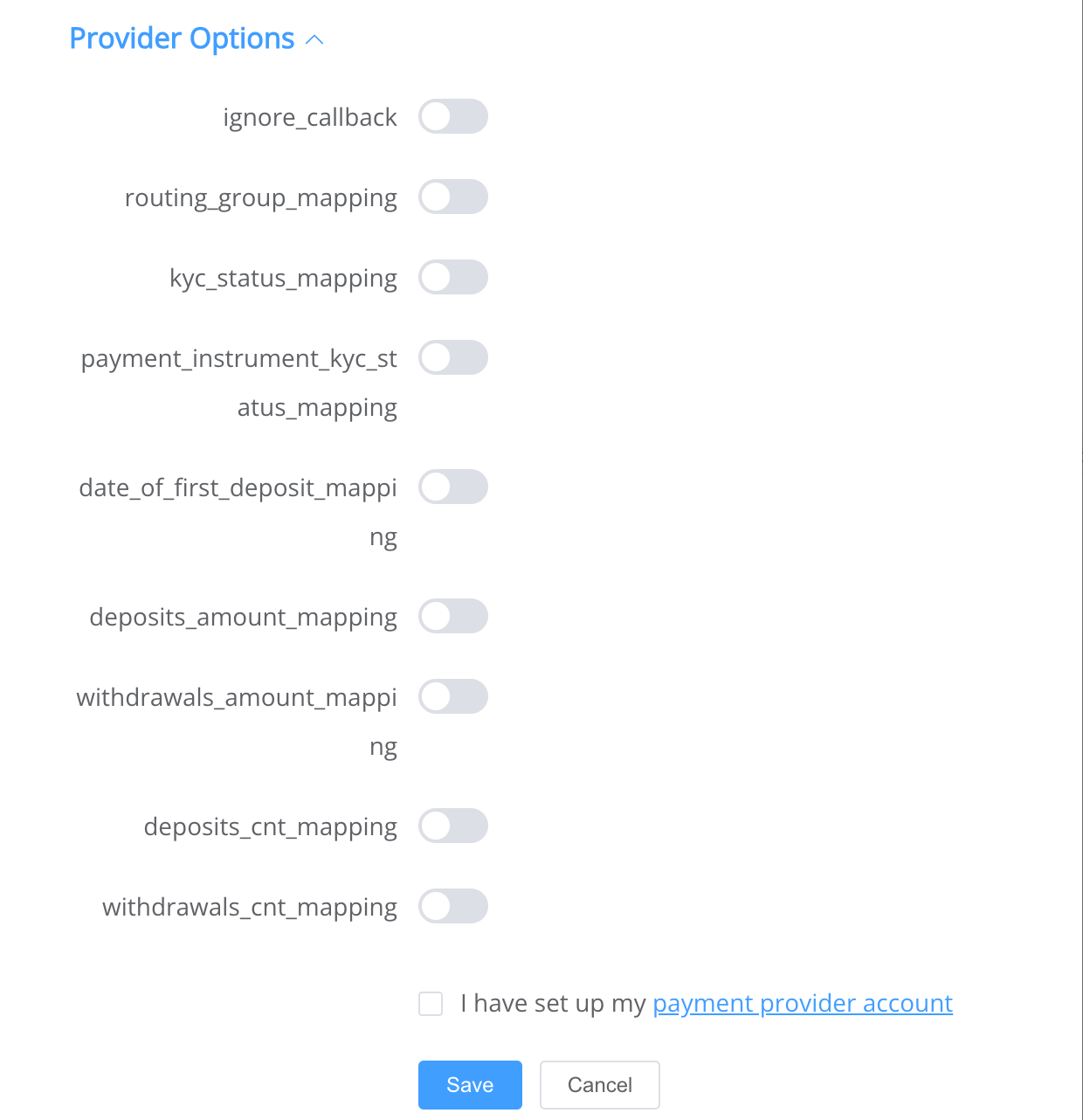

Provider Options for H2H merchant account¶

- ignore_callback - For cascading to work correctly, we exclude the possibility of finalizing payments using asynchronous callbacks, ignore the callback, do not change the status of the transaction on it in any way and rely only on the status request for finalization (Reconciliation)

- routing_group_mapping - Identify the customer as belonging to a specific group that is used for routing.

- kyc_status_mapping - Indicates whether the customer has passed KYC verification or not.

- payment_instrument_kyc_status_mapping - Indicates whether the payment instrument (usually the card number) has passed KYC verification

- date_of_first_deposit_mapping - Date of the first deposit from the customer.

- deposits_amount_mapping - How much the customer has deposited already, in the base currency.

- withdrawals_amount_mapping - How much the customer has withdrawn already, in the base currency.

- deposits_cnt_mapping - How many times the customer made a deposit.

- withdrawals_cnt_mapping - How many times the customer made a withdrawal.

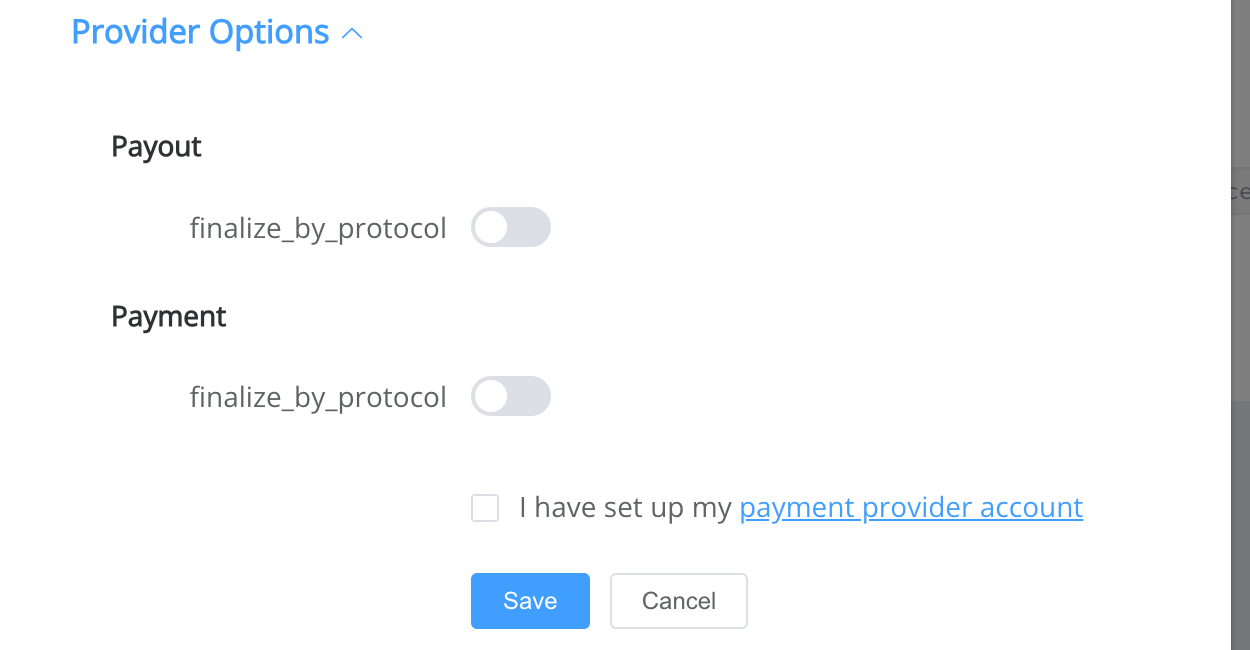

Provider Options for Provider account¶

- finalize_by_protocol

- The provider does not guarantee the finality of the fail status because in their system it can later change to success and if the merchant does not agree with this logic then there is no need to enable this option.

- Then we (Corefy) will stop failing payments but the merchant will not receive transaction status discrepancies.

- If a merchant wants to fail decline which the provider does not guarantee then you need to enable this option.

- The provider does not guarantee the finality of the fail status because in their system it can later change to success and if the merchant does not agree with this logic then there is no need to enable this option.

Still looking for help connecting your PayAdmit account?